Anyone who wants to get to the truth behind the inflationary threats to their wealth should ignore everything the Central Banks say about inflation and look instead at their actions.

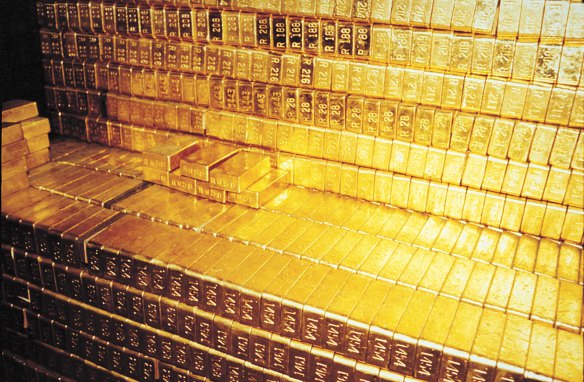

Worldwide gold demand in 2012 was another record high of $236.4 billion in the World Gold Council’s latest report. This was up 6% in value terms in the fourth quarter to $66.2 billion, the highest fourth quarter on record. Global gold demand in the fourth quarter of 2012 was up 4% to 1,195.9 tonnes.

Central bank buying for 2012 rose by 17% over 2011 to some 534.6 tonnes. As far as central bank gold buying, this was the highest level since 1964. Central bank purchases stood at 145 tonnes in the fourth quarter. That is up 9% from the fourth quarter of 2011, and the eighth consecutive quarter in which central banks were net purchasers of gol

http://247wallst.com/2013/02/14/central-banks-buy-the-most-gold-since-1964/#ixzz2LMLOfBPK

Note… Central Banks, while talking down money printing and denying the presence of inflation, bought more Gold in 2012 that any year dating back to 1964. Indeed, However, since becoming net buyers of Gold in 2010, the Central Banks have been increasing their Gold purchases rapidly.

and denying the presence of inflation, bought more Gold in 2012 that any year dating back to 1964. Indeed, However, since becoming net buyers of Gold in 2010, the Central Banks have been increasing their Gold purchases rapidly.

In 2010, Governments worldwide bought 77 tonnes of Gold. In 2011 it was 457 tonnes. And last year it was a whopping 535 tonnes. All told, they’ve accumulated 1,000 tonnes of Gold since 2Q09. At today’s price of $1600 per ounce, this stash is valued at over $56 billion.

The key issue here is not the amount ($56 billion in Gold purchases is nothing compared to the over $10 trillion in new money Central banks have printed since 2007), but the trend: Central Banks were net sellers of Gold for decades until 2010.

Central banks have printed since 2007), but the trend: Central Banks were net sellers of Gold for decades until 2010.

Other major investors are looking to get their hands on Gold… not the promise of Gold, but the actual metal.

Germany has the second largest Gold reserves in the world behind the US. Since the early ’80s, it has stored the majority of these reserves with the NY Fed (45% vs. 13% in London, 11% in Paris and the remaining 31% in Frankfurt).

With that in mind, everyone needs to be aware that last Monday Germany’s Bundesbank announced it will be moving a major portion of its reserves from the US and all of its reserves from France back to Frankfurt.

Nearly half of Germany’s gold reserves are held in a vault at the Federal Reserve Bank of New York — billions of dollars worth of postwar geopolitical history squirreled away for safe keeping below the streets of Lower Manhattan.

Now the German central bank wants to make a big withdrawal — 300 tons in all.

On Wednesday, the Bundesbank said that it would begin moving some of the reserves, the second-largest stock in the world after that of the United States. The goal is to house more than 50 percent of German gold in Bundesbank vaults in Frankfurt by 2020, up from a little less than a third today, the bank said…

The new policy will include the complete withdrawal of 374 tons of German gold stored at the Banque de France in Paris, about 11 percent of the total. Bundesbank officials were quick to note that the decision was not a reflection of French trustworthiness. Rather, because France and Germany now share the euro, there is no need for reserves as insurance against currency crises.

http://www.nytimes.com/2013/01/17/business/global/german-central-bank-to-repatriate-gold-reserves.html

This announcement came with the usual political statements that the decision had nothing to do with a lack of trust between the Bundesbank and the US Fed or Bank of France, but the message is obvious: Germany sees the writing on the wall and is moving to secure its Gold reserves.

The same goes for Texas:

Texas Republican State Representative Giovanni Capriglione authored the bill demanding state owned gold bars be returned to the Lone Star State. The legislation to pull $1 billion in gold reserves from a Federal Reserve vault in New York is supported by Governor Rick Perry.

The financial crisis in Cyprus which prompted a run on the bank and ultimately a closure of the financial institutions reportedly bolstered support for the Texas gold bar return bill. State Representative Capriglione had this to say about why he penned the bill:

“For us to have our own gold, a lot of the runs on the bank and those types of things, they happen because people are worried that there’s nothing there to back it up.”

Governor Perry stated that if Texas owns the gold, then no one else should be able to determine if the state can reclaim possession of the bars of precious metal. Representative Capriglione also noted that Texas is not interested in implementing its own gold standard. According to the Republican’s statements about the gold bars bill, he simply wants to bolster the state’s fiscally secure reputation. The Texas public servant also feels that such a solid financial persona would be beneficial in case an international of national fiscal crisis occurred.

The legislation notes the state does not merely want gold certificates from the Federal Reserve, they want the actual gold bars to store inside a planned Texas Bullion Depository. Moving $1 billion in gold bars from New York to Texas would be a huge task, one some are calling impractical. State Representative Capriglione suggested selling the gold currently housed inside the New York vault and then repurchasing the same amount in Texas.

http://www.inquisitr.com/600185/texas-wants-gold-stored-at-federal-reserve-returned-to-lone-star-state/#XHeg60ztpexhAROW.99

Investors forget that the single most important role played by Central Banks is to maintain confidence in the system. For that reason they will NEVER admit inflation is a problem. But if inflation isn’t a problem, WHY ARE CENTRAL BANKS LOADING UP ON GOLD?

Watch what they do, not what they say.

To learn more about Private Wealth Advisory…

Best Regards,

Graham Summers

Read more at http://investmentwatchblog.com/why-are-central-banks-buying-gold/#AD11VJB1LRmRodrl.99

(Zero Hedge) The lack of faith in central bank trustworthiness is spreading. First Germany, then Holland, and Austria, and now - as we noted was possible previously - Texas has enacted a Bill to repatriate $1 billion of gold from The NY Fed’s vaults to a newly established state gold bullion depository…”People have this image of Texas as big and powerful … so for a lot of people, this is exactly where they would want to go with their gold,” and the Bill includes a section to prevent forced seizure from the Federal Government. Continue reading

(Zero Hedge) The lack of faith in central bank trustworthiness is spreading. First Germany, then Holland, and Austria, and now - as we noted was possible previously - Texas has enacted a Bill to repatriate $1 billion of gold from The NY Fed’s vaults to a newly established state gold bullion depository…”People have this image of Texas as big and powerful … so for a lot of people, this is exactly where they would want to go with their gold,” and the Bill includes a section to prevent forced seizure from the Federal Government. Continue reading

New money: More than a dozen states have pushed laws through so that gold and silver can be used as legal tender

New money: More than a dozen states have pushed laws through so that gold and silver can be used as legal tender

Loss of faith: Conservative politicians are concerned about the economic policies put into place by Ben Bernanke during his time as the chairman of the federal reserve

Loss of faith: Conservative politicians are concerned about the economic policies put into place by Ben Bernanke during his time as the chairman of the federal reserve

Angry Arizonans: The Arizona House of Representatives passed the law through and now it continues through the process before it goes ahead an is enacted in the state

Angry Arizonans: The Arizona House of Representatives passed the law through and now it continues through the process before it goes ahead an is enacted in the state

(dinarvets.com) U.S DEPARTMENT OF HOMELAND SECURITY HAS TOLD BANKS – IN WRITING – IT MAY INSPECT SAFE DEPOSIT BOXES WITHOUT WARRANT AND SEIZE ANY GOLD, SILVER, GUNS OR OTHER VALUABLES IT FINDS INSIDE THOSE BOXES!

(dinarvets.com) U.S DEPARTMENT OF HOMELAND SECURITY HAS TOLD BANKS – IN WRITING – IT MAY INSPECT SAFE DEPOSIT BOXES WITHOUT WARRANT AND SEIZE ANY GOLD, SILVER, GUNS OR OTHER VALUABLES IT FINDS INSIDE THOSE BOXES! The idea is that while you and I are required to transact business with piece of paper and ink, large banks and nations still settle their accounts with gold, which is simply wheeled from one nation’s vault to another to settle a debt, all of it under the roof of the Federal Reserve Gold Depository in New York City, or the similar institutions at the Bank of England and Band of France.

The idea is that while you and I are required to transact business with piece of paper and ink, large banks and nations still settle their accounts with gold, which is simply wheeled from one nation’s vault to another to settle a debt, all of it under the roof of the Federal Reserve Gold Depository in New York City, or the similar institutions at the Bank of England and Band of France.

It quickly became apparent that the problem of tungsten filled bullion bars was widespread. Because many of the fake gold bars had the marking of US sources, nations began to ask for audits and tests of the gold bullion held in their name by the New York Federal Reserve. To the surprise of many, the New York Federal Reserve refused! Indeed the New York Federal Reserve refused the German government permission to simply look at their bullion! Germany’s private central bank then went public assuring the Germans that they trusted America’s private central bank and did not need to see the gold. That was followed by a bizarre

It quickly became apparent that the problem of tungsten filled bullion bars was widespread. Because many of the fake gold bars had the marking of US sources, nations began to ask for audits and tests of the gold bullion held in their name by the New York Federal Reserve. To the surprise of many, the New York Federal Reserve refused! Indeed the New York Federal Reserve refused the German government permission to simply look at their bullion! Germany’s private central bank then went public assuring the Germans that they trusted America’s private central bank and did not need to see the gold. That was followed by a bizarre