Too Big Banks Try End Run to Kill Growing Public Banking Movement

The Trans-Pacific Partnership (TPP) is an international treaty negotiated in secret – hidden even from congressmen who oversee such treaties – which threatens to destroy national sovereignty.

Public banks – such as the Bank of North Dakota – can provide low-cost loans to Main Street, when Wall Street insists on high interest rates … or won’t even extend credit.

More and more states are considering launching their own public banks.

A 2011 study from Demos – a non-partisan public policy organization – in conjunction with the Center for State Innovation, analyzed the potential for “partnership banks” across the country, including numerous states already considering such legislation. The study found:

Across the country, states are considering proposals to move general revenue deposits out of the Wall Street banks that dominate the banking business today, and use them to capitalize a new local public structure with a mission to grow the local economy. A “Main Street Partnership Bank” would be modeled on the nearly 100-year-old public Bank of North Dakota (BND). This public policy innovation—also known as a Public Bank or State Bank—could contribute to the health of local community banks, state budgets and small business job growth in an era of rapid banking concentration, budget deficits and disinvestment on Main Street.

Partnership Banks can raise revenue for states without raising taxes, and increase loans to small businesses precisely when Wall Street banks have cut back on lending and raised public borrowing costs. A Partnership Bank would act as a “banker’s bank” to in-state community banks and provide the state government with both banking services at fair terms and an annual multi-million dollar dividend.

If modeled on the successful Bank of North Dakota, Partnership Banks in other states would:

- Create new jobs and spur economic growth. Partnership Banks are participation lenders, meaning they partner—never compete—with local banks to drive lending through local banks to small businesses. If Washington State had a fully-operational Partnership Bank capitalized at $100 million during the Great Recession, it would have supported $2.6 billion in new lending and helped to create 8,212 new small business jobs. A proposed Oregon bank could help community banks expand lending by $1.3 billion and help small business create 5,391 new Oregon jobs in its first three to five years. All of this would be accom- plished at a profit, which Partnership Banks should share with the state.

- Generate new revenues for states directly, through annual bank dividend payments, and indirectly by creating jobs and spurring local economic growth…

- Lower debt costs for local governments. Like the Bank of North Dakota, Partnership Banks can get access to low-cost funds from the regional Federal Home Loan Banks. The banks can pass savings on to local governments when they buy debt for infrastructure investments. The banks can also provide Letters of Credit for tax-exempt bonds at lower interest rates.

- Strengthen local banks even out credit cycles, and preserve real competition in local credit markets. There have been no bank failures in North Dakota during the financial crisis. BND’s charter is clear that its goal is to “be helpful to and to assist in the development of [North Dakota banks]… and not, in any manner, to destroy or to be harmful to existing financial institutions.” By purchasing local bank stock, partnering with them on large loans and providing other sup- port, Partnership Banks would strengthen small banks in an era when federal policy encourages bank consolidation.

- Build up small businesses. Surveys by the Main Street Alliance in Oregon and Washington show at least 75 percent support among small business owners. In markets increasingly dominated by large corporations and the banks that fund them, Partnership Banks would increase lending capabilities at the smaller banks that provide the majority of small business loans in America.

These various proposals would “move general revenue deposits out of the Wall Street banks that dominate the banking business today, and use them to capitalize a new local public structure with a mission to grow the local economy.”

This would obviously cut into the big banks’ profits. Indeed, the big banks have engaged in mafia-style big-rigging fraud against local governments (see this, this and this), scalped local governments by manipulating interest rates, and engaged in all sorts of other shenanigans to fleece governments, businesses and citizens.

And the big banks are using dirty tricks to try to kill the growing public banking movement, so as to protect their racket.

Les Leopold writes:

Clearly, from Wall Street’s perspective, the North Dakota bank must go, and all other state efforts to replicate it must be thwarted. Wall Street’s stealth weapon may be lodged within the latest corporate trade agreement called the Trans-Pacific Partnership (TPP), which currently is being negotiated in secret. We already know that Wall Street is seeking to remove all tariff restrictions that prevent the U.S. financial services industry from doing business in countries like Brunei, Chile, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. The biggest banks also want the treaty to eliminate “non-tariff” barriers including regulations that create “unfair” competition with state-owned financial enterprises.

Depending on the final language, it is possible that the activities of the Bank of North Dakota could be ruled illegal because “foreign bankers could claim the BND stops them from lending to commercial banks throughout the state” …. How perfect for Wall Street: a foreign bank can be used as a shill to knock out the BND.

Truthout explains:

Legislators around the world are being kept in the dark about what they’re voting on until the deal [on TPP] is hammered out; it’s expected to be completed this year. When it’s finished, if the experience of Congress here is any indication, legislators will be feeling extraordinary pressure from corporate lobbyists and their heads of state to accept the deal without a fuss. [Indeed, lawmakers often vote on legislation without ever reading it.]

***

Publicly owned enterprises, for example, are being targeted by negotiators. One such entity in the United States that has been the subject of considerable interest in recent years is the Bank of North Dakota (BND) – the only fully publicly owned financial institution in the country. The BND, which is only allowed to lend wholesale, was a stabilizing force that helped keep the already energy-rich state insulated from the shock of the financial crisis (Alaska, for example, didn’t fare as well). It has also brought a small fortune to the state’s treasury – $340 million in net tax gain between 1997 and 2009. Legislators in at least 13 different states have proposed studying or emulating the North Dakota model – state-owned development of central-bank style institutions guaranteed by tax revenue. But if the TPP is passed, that option might not be available. [Barbara Weisel, the top American government negotiator for TPP] said that State Owned Enterprises (SOE) are routinely “competing directly with private enterprises, and often in a way that is considered unfair.”

“Some of the advantages that can be conferred on State Owned Enterprises are things like preferential financing,” Weisel said. “Those are things that wouldn’t be provided to private companies – preferential provision of goods and services provided by a government.”

She said that “State Owned Enterprises – which in some cases can comprise a significant percentage of an economy – can be used to undermine what we’re otherwise trying to gain from this free trade agreement.”

A spokesperson for the BND declined to comment on whether or not this outlook was perceived by the bank to be an institutional threat. But, depending on the report’s language, foreign bankers could claim that the BND stops them from lending to commercial banks throughout the state.

Citigroup’s Johnston [Rick Johnston is a a senior vice president and director for international government affairs at Citigroup], in response to another question from the audience, said that corporations weren’t exactly enamored of competition with publicly owned enterprises – and that they are prodding TPP delegates into doing something about it.

“The companies that are running up against the problem and the challenges of the state-owned enterprises, they obviously feel strongly enough about it that the problem is being addressed within the negotiations,” he said.

***

There can be no guarantee, until the draft is finally released, that the TPP will protect entities like the BND, especially when considering, as critics have contended, that the deal’s boosters are pushing an agreement that more firmly entrenches capital flow as a form of trade.

“When you hear the word ‘trade‘ in today’s business world, it doesn’t just mean goods moving across borders,” Johnston said. “It doesn’t even mean just services moving across borders. It also means investment. And that’s something where the TPP is really gonna make a big difference.”

Trade, according to Black’s Law dictionary, is defined as “Traffic; commerce, exchangeof goods for other goods, or for money.” Yet this trade pact could usher in a rash of reforms, with minimal oversight and virtually no public hearings, treating investment rules as a trade issue, even though they haven’t traditionally been dealt with as such.

A lobbyist’s world-view on this issue is instructive. As Michael Wendell told the Congressional Subcommittee on Trade:

SOEs [state-owned enterprises], by definition, are interested in promoting the interests of their home country, and are all too often guided by state interests, rather than commercial interests.

Why does this matter? Let’s consider a Chinese SOE. Chinese SOEs benefit enormously from below-market-rate financing by state-owned banks at rates well below what American companies pay. Many of these loans may not have to be repaid at all. How does a commercial entity here in the U.S. compete with the U.S.-based operations of an SOE that sets up shop here?

***

There are many ways that disciplines on SOEs can be developed as part of the TPP talks. The best approach would be to ensure that all transactions are based on commercial considerations.

Basing all transactions on “commercial considerations” may sound okay initially. But that would – in essence – mean that the interests of the banks in making high-interest rate loans are more important than the interests of the people in obtaining cheap loans.

Moreover, America as a nation is arguably paying trillions of dollars to the big banks in unnecessary interest costs which public banks would render moot. See this and this.

And remember, the Founding Fathers’ vision of prosperity was largely based around public banking.

However we decide to treat foreign state-owned enterprises, banks owned by the American people will help to create prosperity for we the people and our small businesses.

Indeed, both conservative and liberal economists point out that the big banks are already state-sponsored institutions … so the government should create a little competition through public banking.

State-owned public banks – like North Dakota has – would take the power away from the big banks, andgive it back to the people … as the Founding Fathers intended.

Don’t trust the federal government? That’s fine … we’re not talking about state – not federal – banks. Don’t trust your state? Then support a county-level bank.

Postscript: Obama is a shill for TPP. So is Treasury Secretary Jack Lew, who told the Senate:

As Deputy Secretary of the State Department, I actively promoted the United States’ entry into the Trans-Pacific Partnership negotiations.

For that reason, the minutes are usually highly protected by the central bank and their release is supposed to be executed carefully.

For that reason, the minutes are usually highly protected by the central bank and their release is supposed to be executed carefully.

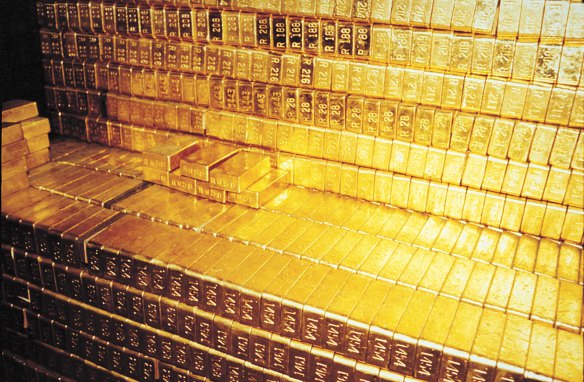

(dinarvets.com) U.S DEPARTMENT OF HOMELAND SECURITY HAS TOLD BANKS – IN WRITING – IT MAY INSPECT SAFE DEPOSIT BOXES WITHOUT WARRANT AND SEIZE ANY GOLD, SILVER, GUNS OR OTHER VALUABLES IT FINDS INSIDE THOSE BOXES!

(dinarvets.com) U.S DEPARTMENT OF HOMELAND SECURITY HAS TOLD BANKS – IN WRITING – IT MAY INSPECT SAFE DEPOSIT BOXES WITHOUT WARRANT AND SEIZE ANY GOLD, SILVER, GUNS OR OTHER VALUABLES IT FINDS INSIDE THOSE BOXES!