Veterans Today – by Dean Henderson

(Excerpted from Chapter 19: The Eight Families: Big Oil & Their Bankers in the Persian Gulf… Part two of a five-part series)

In 1789 Alexander Hamilton became the first Treasury Secretary of the United States. Hamilton was one of many Founding Fathers who were Freemasons. He had close relations with the Rothschild family which owns the Bank of England and leads the European Freemason movement. George Washington, Benjamin Franklin, John Jay, Ethan Allen, Samuel Adams, Patrick Henry, John Brown and Roger Sherman were all Masons.

Roger Livingston helped Sherman and Franklin write the Declaration of Independence. He gave George Washington his oaths of office while he was Grand Master of the New York Grand Lodge of Freemasons. Washington himself was Grand Master of the Virginia Lodge. Of the General Officers in the Revolutionary Army, thirty-three were Masons. This was highly symbolic, since 33rd Degree Masons become Illuminated. [1]

Populist founding fathers led by John Adams, Thomas Jefferson, James Madison and Thomas Paine – none of whom were Masons – wanted to completely severe ties with the British Crown, but were overruled by the Masonic faction led by Washington, Hamilton and Grand Master of the St. Andrews Lodge in Boston General Joseph Warren, who wanted to “defy Parliament but remain loyal to the Crown”. St. Andrews Lodge was the hub of New World Masonry and began issuing Knights Templar Degrees in 1769. [2]

All US Masonic lodges are to this day warranted by the British Crown, whom they serve as a global intelligence and counterrevolutionary subversion network. Their most recent initiative is the Masonic Child Identification Program (CHIP). According toWikipedia, the CHIP programs allow parents the opportunity to create a kit of identifying materials for their child, free of charge. The kit contains a fingerprint card, a physical description, a video, computer disk, or DVD of the child, a dental imprint, and a DNA sample.

The First Continental Congress convened in Philadelphia in 1774 under the Presidency of Peyton Randolph, who succeeded Washington as Grand Master of the Virginia Lodge. The Second Continental Congress convened in 1775 under the Presidency of Freemason John Hancock. Peyton’s brother William succeeded him as Virginia Lodge Grand Master and became the leading proponent of centralization and federalism at the First Constitutional Convention in 1787. The federalism at the heart of the US Constitution is identical to the federalism laid out in the Freemason’s Anderson’s Constitutions of 1723. William Randolph became the nation’s first Attorney General and Secretary of State under George Washington. His family returned to England loyal to the Crown. John Marshall, the nation’s first Supreme Court Justice, was also a Mason. [3]

All US Masonic lodges are to this day warranted by the British Crown,

whom they serve as a global intelligence and counterrevolutionary subversion network.

When Benjamin Franklin journeyed to France to seek financial help for American revolutionaries, his meetings took place at Rothschild banks. He brokered arms sales via German Mason Baron von Steuben. His Committees of Correspondence operated through Freemason channels and paralleled a British spy network. In 1776 Franklin became de facto Ambassador to France. In 1779 he became Grand Master of the French Neuf Soeurs (Nine Sisters) Lodge, to which John Paul Jones and Voltaire belonged. Franklin was also a member of the more secretive Royal Lodge of Commanders of the Temple West of Carcasonne, whose members included Frederick Prince of Whales. While Franklin preached temperance in the US, he cavorted wildly with his Lodge brothers in Europe. Franklin served as Postmaster General from the 1750’s to 1775 – a role traditionally relegated to British spies. [4]

With Rothschild financing Alexander, Hamilton founded two New York banks, including Bank of New York. [5] He died in a gun battle with Aaron Burr, who founded Bank of Manhattan with Kuhn Loeb financing. Hamilton exemplified the contempt which the Eight Families hold towards common people, once stating, “All communities divide themselves into the few and the many. The first are the rich and the well born, the others the mass of the people… The people are turbulent and changing; they seldom judge and determine right. Give therefore to the first class a distinct, permanent share of government. They will check the unsteadiness of the second.”[6]

Hamilton was only the first in a series of Eight Families cronies to hold the key position of Treasury Secretary. In recent times Kennedy Treasury Secretary Douglas Dillon came from Dillon Read (now part of UBS Warburg). Nixon Treasury Secretaries David Kennedy and William Simon came from Continental Illinois Bank (now part of Bank of America) and Salomon Brothers (now part of Citigroup), respectively. Carter Treasury Secretary Michael Blumenthal came from Goldman Sachs, Reagan Treasury Secretary Donald Regan came from Merrill Lynch (now part of Bank of America), Bush Sr. Treasury Secretary Nicholas Brady came from Dillon Read (UBS Warburg) and both Clinton Treasury Secretary Robert Rubin and Bush Jr. Treasury Secretary Henry Paulson came from Goldman Sachs. Obama Treasury Secretary Tim Geithner worked at Kissinger Associates and the New York Fed.

Thomas Jefferson argued that the United States needed a publicly-owned central bank so that European monarchs and aristocrats could not use the printing of money to control the affairs of the new nation. Jefferson extolled, “A country which expects to remain ignorant and free…expects that which has never been and that which will never be.” There is scarcely a King in a hundred who would not, if he could, follow the example of Pharaoh – get first all the people’s money, then all their lands and then make them and their children servants forever…banking establishments are more dangerous than standing armies. Already they have raised up a money aristocracy.” Jefferson watched as the Euro-banking conspiracy to control the United States unfolded, weighing in, “Single acts of tyranny may be ascribed to the accidental opinion of the day, but a series of oppressions begun at a distinguished period, unalterable through every change of ministers, too plainly prove a deliberate, systematic plan of reducing us to slavery”. [7]

Thomas Jefferson argued that the United States needed a publicly-owned central bank so that European monarchs and aristocrats could not use the printing of money to control the affairs of the new nation.

But the Rothschild-sponsored Hamilton’s arguments for a private US central bank carried the day. In 1791 the Bank of the United States (BUS) was founded, with the Rothschilds as main owners. The bank’s charter was to run out in 1811. Public opinion ran in favor of revoking the charter and replacing it with a Jeffersonian public central bank. The debate was postponed as the nation was plunged by the Euro-bankers into the War of 1812. Amidst a climate of fear and economic hardship, Hamilton’s bank got its charter renewed in 1816.

Old Hickory, Honest Abe & Camelot

In 1828 Andrew Jackson took a run at the US Presidency. Throughout his campaign he railed against the international bankers who controlled the BUS. Jackson ranted, “You are a den of vipers. I intend to expose you and by Eternal God I will rout you out. If the people understood the rank injustices of our moneyand banking system there would be a revolution before morning.”

In 1828 Andrew Jackson took a run at the US Presidency. Throughout his campaign he railed against the international bankers who controlled the BUS. Jackson ranted, “You are a den of vipers. I intend to expose you and by Eternal God I will rout you out. If the people understood the rank injustices of our moneyand banking system there would be a revolution before morning.”

Jackson won the election and revoked the bank’s charter stating, “The Act seems to be predicated on an erroneous idea that the present shareholders have a prescriptive right to not only the favor, but the bounty of the government…for their benefit does this Act exclude the whole American people from competition in the purchase of this monopoly. Present stockholders and those inheriting their rights as successors be established a privileged order, clothed both with great political power and enjoying immense pecuniary advantages from their connection with government. Should its influence be concentrated under the operation of such an Act as this, in the hands of a self-elected directory whose interests are identified with those of the foreign stockholders, will there not be cause to tremble for the independence of our country in war…controlling our currency, receiving our public monies and holding thousands of our citizens independence, it would be more formidable and dangerous than the naval and military power of the enemy. It is to be regretted that the rich and powerful too often bend the acts of government for selfish purposes…to make the rich richer and more powerful. Many of our rich men have not been content with equal protection and equal benefits, but have besought us to make them richer by acts of Congress. I have done my duty to this country.”[8]

Populism prevailed and Jackson was re-elected. In 1835 he was the target of an assassination attempt. The gunman was Richard Lawrence, who confessed that he was, “in touch with the powers in Europe”. [9]

Still, in 1836 Jackson refused to renew the BUS charter. Under his watch the US national debt went to zero for the first and last time in our nation’s history. This angered the international bankers, whose primary income is derived from interest payments on debt. BUS President Nicholas Biddle cut off funding to the US government in 1842, plunging the US into a depression. Biddle was an agent for the Paris-based Jacob Rothschild. [10]

“You are a den of vipers. I intend to expose you and by Eternal God I will rout you out. If the people understood the rank injustices of our money and banking system there would be a revolution before morning.” Andrew Jackson

The Mexican War was simultaneously sprung on Jackson. A few years later the Civil War was unleashed, with London bankers backing the Union and French bankers backing the South. The Lehman family made a fortune smuggling arms to the south and cotton to the north. By 1861 the US was $100 million in debt. New President Abraham Lincoln snubbed the Euro-bankers again, issuing Lincoln Greenbacks to pay Union Army bills.

The Rothschild-controlled Times of Londonwrote, “If that mischievous policy, which had its origins in the North American Republic, should become indurated down to a fixture, then that Government will furnish its own money without cost. It will pay off its debts and be without debt. It will have all the money necessary to carry on its commerce. It will become prosperous beyond precedent in the history of the civilized governments of the world. The brains and the wealth of all countries will go to North America. That government must be destroyed, or it will destroy every monarchy on the globe.” [11]

The Euro-banker-written Hazard Circularwas exposed and circulated throughout the country by angry populists. It stated, “The great debt that capitalists will see is made out of the war and must be used to control the valve of money. To accomplish this government bonds must be used as a banking basis. We are now awaiting Secretary of Treasury Salmon Chase to make that recommendation. It will not allow Greenbacks to circulate as money as we cannot control that. We control bonds and through them banking issues”.

The 1863 National Banking Act reinstated a private US central bank and Chase’s war bonds were issued. Lincoln was re-elected the next year, vowing to repeal the act after he took his January 1865 oaths of office. Before he could act, he was assassinated at the Ford Theatre by John Wilkes Booth. Booth had major connections to the international bankers. His granddaughter wrote This One Mad Act, which details Booth’s contact with “mysterious Europeans” just before the Lincoln assassination.

Following the Lincoln hit, Booth was whisked away by members of a secret society known as Knights of the Golden Circle (KGC). KGC had close ties to the French Society of Seasons, which produced Karl Marx. KGC had fomented much of the tension that caused the Civil War and President Lincoln had specifically targeted the group. Booth was a KGC member and was connected through Confederate Secretary of State Judah Benjamin to the House of Rothschild. Benjamin fled to England after the Civil War. [12]

Nearly a century after Lincoln was assassinated for issuing Greenbacks, President John F. Kennedy found himself in the Eight Families’  crosshairs. Kennedy had announced a crackdown on off-shore tax havens and proposed increases in tax rates on large oil and mining companies. He supported eliminating tax loopholes that benefitted the super-rich. His economic policies were publicly attacked by Fortune magazine, the Wall Street Journaland both David and Nelson Rockefeller. Even Kennedy’s own Treasury Secretary Douglas Dillon, who came from the UBS Warburg-controlled Dillon Read investment bank, voiced opposition to the JFK proposals. [13]

crosshairs. Kennedy had announced a crackdown on off-shore tax havens and proposed increases in tax rates on large oil and mining companies. He supported eliminating tax loopholes that benefitted the super-rich. His economic policies were publicly attacked by Fortune magazine, the Wall Street Journaland both David and Nelson Rockefeller. Even Kennedy’s own Treasury Secretary Douglas Dillon, who came from the UBS Warburg-controlled Dillon Read investment bank, voiced opposition to the JFK proposals. [13]

Kennedy’s fate was sealed in June 1963 when he authorized the issuance of more than $4 billion in United States Notes by his Treasury Department in an attempt to circumvent the high interest rate usury of the private Federal Reserve international banker crowd. The wife of Lee Harvey Oswald, who was conveniently gunned down by Jack Ruby before Ruby himself was shot, told author A. J. Weberman in 1994, “The answer to the Kennedy assassination is with the Federal Reserve Bank. Don’t underestimate that. It’s wrong to blame it on Angleton and the CIA per seonly. This is only one finger on the same hand. The people who supply the money are above the CIA”. [14]

Fueled by incoming President Lyndon Johnson’s immediate escalation of the Vietnam War, the US sank further into debt. Its citizens were terrorized into silence. If they could kill the President they could kill anyone.

The House of Rothschild

The Dutch House of Orange founded the Bank of Amsterdam in 1609 as the world’s first central bank. Prince William of Orange married into the English House of Windsor, taking King James II’s daughter Mary as his bride. The Orange Order Brotherhood, which recently fomented Northern Ireland Protestant violence, put William III on the English throne where he ruled both Holland and Britain. In 1694 William III teamed up with the UK aristocracy to launch the private Bank of England.

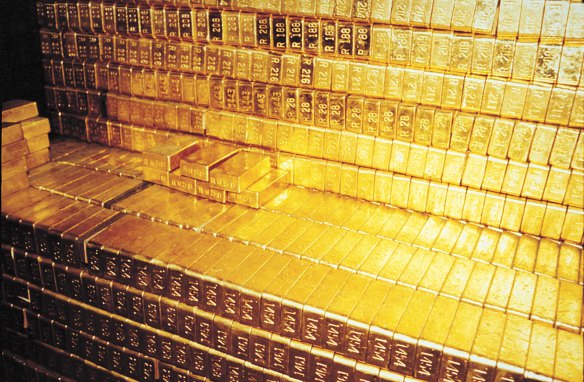

The Old Lady of Threadneedle Street- as the Bank of England is known- is surrounded by thirty foot walls. Three floors beneath it the third largest stock of gold bullion in the world is stored. [15]

The Rothschilds and their inbred Eight Families partners gradually came to control the Bank of England. The daily London gold “fixing” occurred at the N. M. Rothschild Bank until 2004. As Bank of England Deputy Governor George Blunden put it, “Fear is what makes the bank’s powers so acceptable. The bank is able to exert its influence when people are dependent on us and fear losing their privileges or when they are frightened.”[16]

“If they could kill the President they could kill anyone.”

Mayer Amschel Rothschild sold the British government German Hessian mercenaries to fight against American Revolutionaries, diverting the proceeds to his brother Nathan in London, where N.M. (Nathan and Mayer) Rothschild & Sons was established. Mayer was a serious student of Cabala and launched his fortune on money embezzled from William IX- royal administrator of the Hesse-Kassel region and a prominent Freemason.

Rothschild-controlled Barings bankrolled the Chinese opium and African slave trades. It financed the Louisiana Purchase. When several states defaulted on its loans, Barings bribed Daniel Webster to make speeches stressing the virtues of loan repayment. The states held their ground, so the House of Rothschild cut off the money spigot in 1842, plunging the US into a deep depression. It was often said that the wealth of the Rothschilds depended on the bankruptcy of nations. Mayer Amschel Rothschild once said, “I care not who controls a nation’s political affairs, so long as I control her currency”.

War didn’t hurt the family fortune either. The House of Rothschild financed the Prussian War, the Crimean War and the British attempt to seize the Suez Canal from the French. Nathan Rothschild made a huge financial bet on Napoleon at the Battle of Waterloo, while also funding the Duke of Wellington’s peninsular campaignagainstNapoleon. Both the Mexican War and the Civil War were goldmines for the family.

One Rothschild family biography mentions a London meeting where an “International Banking Syndicate” decided to pit the American North against the South as part of a “divide and conquer” strategy. German Chancellor Otto von Bismarck once stated, “The division of the United States into federations of equal force was decided long before the Civil War. These bankers were afraid that the United States…would upset their financial domination over the world. The voice of the Rothschilds prevailed.” Rothschild biographer Derek Wilson says the family was the official European banker to the US government and strong supporters of the Bank of the United States. [17]

Family biographer Niall Ferguson notes a “substantial and unexplained gap” in private Rothschild correspondence between 1854-1860. He says all copies of outgoing letters written by the London Rothschilds during this Civil War period “were destroyed at the orders of successive partners”. [18]

French and British troops had, at the height of the Civil War, encircled the US. The British sent 11,000 troops to Crown-controlled Canada, which gave safe harbor to Confederate agents. France’s Napoleon III installed Austrian Hapsburg family member Archduke Maximilian as his puppet emperor in Mexico, where French troops massed on the Texas border. Only an 11th-hour deployment of two Russian warship fleets by US ally Czar Alexander II in 1863 saved the United States from re-colonization. [19]

That same year the Chicago Tribune blasted, “Belmont (August Belmont was a US Rothschild agent and had a Triple Crown horse race named in his honor) and the Rothschilds…who have been buying up Confederate war bonds.”

Salmon Rothschild said of a deceased President Lincoln, “He rejects all forms of compromise. He has the appearance of a peasant and can only tell barroom stories.” Baron Jacob Rothschild was equally flattering towards the US citizenry. He once commented to US Minister to Belgium Henry Sanford on the over half a million Americans who died during the Civil War, “When your patient is desperately sick, you try desperate measures, even to bloodletting.” Salmon and Jacob were merely carrying forth a family tradition. A few generations earlier Mayer Amschel Rothschild bragged of his investment strategy, “When the streets of Paris are running in blood, I buy”. [20]

French and British troops had, at the height of the Civil War, encircled the US. The British sent 11,000 troops to Crown-controlled Canada, which gave safe harbor to Confederate agents.

Mayer Rothschild’s sons were known as the Frankfurt Five. The eldest – Amschel – ran the family’s Frankfurt bank with his father, while Nathan ran London operations. Youngest son Jacob set up shop in Paris, while Salomon ran the Vienna branch and Karl was off to Naples. Author Frederick Morton estimates that by 1850 the Rothschilds were worth over $10 billion. [21] Some researchers believe that their fortune today exceeds $100 trillion.

The Warburgs, Kuhn Loebs, Goldman Sachs, Schiffs and Rothschilds have intermarried into one big happy banking family. The Warburg family- which controls Deutsche Bank and BNP-tied up with the Rothschilds in 1814 in Hamburg, while Kuhn Loeb powerhouse Jacob Schiff shared quarters with Rothschilds in 1785. Schiff immigrated to America in 1865. He joined forces with Abraham Kuhn and married Solomon Loeb’s daughter. Loeb and Kuhn married each others sisters and the Kuhn Loeb dynasty was consummated. Felix Warburg married Jacob Schiff’s daughter. Two Goldman daughters married two sons of the Sachs family, creating Goldman Sachs. In 1806 Nathan Rothschild married the oldest daughter of Levi Barent Cohen, a leading financier in London. [22] Thus, Merrill Lynch super-bull Abby Joseph Cohen and Clinton Secretary of Defense William Cohen are likely descended from Rothschilds.

The Warburgs, Kuhn Loebs, Goldman Sachs, Schiffs and Rothschilds have intermarried into one big happy banking family. The Warburg family- which controls Deutsche Bank and BNP-tied up with the Rothschilds in 1814 in Hamburg, while Kuhn Loeb powerhouse Jacob Schiff shared quarters with Rothschilds in 1785. Schiff immigrated to America in 1865. He joined forces with Abraham Kuhn and married Solomon Loeb’s daughter. Loeb and Kuhn married each others sisters and the Kuhn Loeb dynasty was consummated. Felix Warburg married Jacob Schiff’s daughter. Two Goldman daughters married two sons of the Sachs family, creating Goldman Sachs. In 1806 Nathan Rothschild married the oldest daughter of Levi Barent Cohen, a leading financier in London. [22] Thus, Merrill Lynch super-bull Abby Joseph Cohen and Clinton Secretary of Defense William Cohen are likely descended from Rothschilds.

Today the Rothschild’s control a far-flung financial empire, which includes majority stakes in most world central banks. The Edmond de Rothschild clan owns the Banque Privee SA in Lugano, Switzerland and the Rothschild Bank AG of Zurich. The family of Jacob Lord Rothschild owns the powerful Rothschild Italiain Milan. They are founding members of the exclusive $10 trillion Club of the Isles – which controls corporate giants Royal Dutch Shell, Imperial Chemical Industries, Lloyds of London, Unilever, Barclays, Lonrho, Rio Tinto Zinc, BHP Billiton and Anglo American DeBeers. It dominates the world supply of petroleum, gold, diamonds, and many other vital raw materials. [23]

The Club of the Isles provides capital for George Soros’ Quantum Fund NV – which made a killing in 1998-99 destroying the currencies of Thailand, Indonesia and Russia. Soros was a major shareholder at George W. Bush’s Harken Energy. Quantum NV operates from the Dutch island of Curacao, in the shadow of recently shuttered Royal Dutch/Shell and Exxon Mobil refineries. Curacao was recently cited by an OECD Task Force on Money Laundering as a major drug money laundering nation. The Club of Isles is led by the Rothschilds and includes Queen Elizabeth II and other wealthy European aristocrats and Black Nobility. Fugitive Swiss financier and Mossad cutout Marc Rich, whose business interests were recently taken over by the Russian mafia Alfa Group, is also part of the Soros network. [24]

Ties to drug money are nothing new to the Rothschilds. N. M. Rothschild & Sons was at the epicenter of the Bank of Credit & Commerce International (BCCI) scandal, but escaped the limelight when a warehouse full of documents conveniently burned to the ground around the time Rothschild-controlled Bank of England shut BCCI down.

Recent Rothschild endeavors include the backing of Russian oligarch Mikhail Khodorkovsky, control over Blackstone Group (see “…The 911 Short Selling Financial Scam”), and the takeover of giant Swiss oil trader Glencore.

Perhaps the largest repository for Rothschild wealth today is Rothschilds Continuation Holdings AG – a secretive Swiss-based bank holding company. By the late 1990s scions of the Rothschild global empire were Barons Guy and Elie de Rothschild in France and Lord Jacob and Sir Evelyn Rothschild in Britain. [25]

Evelyn was chairman of the Economistand a director at DeBeers and IBM UK.

Jacob backed Arnold Schwarzenegger’s California gubernatorial campaign. He took control of Khodorkovsky’s YUKOS oil shares just before the Russian government arrested him. In 2010 Jacob joined Rupert Murdoch in a shale oil extraction partnership in Israel through Genie Energy – a subsidiary of IDT Corporation. [26]

Within months, Sarah Palin had hired former IDT executive Michael Glassner as her chief of staff. [27] Was Palin the failed Rothschild choice for 2012?

Next Week – The Federal Reserve Cartel Part III

Dean Henderson is the author of Big Oil & Their Bankers in the Persian Gulf: Four Horsemen, Eight Families & Their Global Intelligence, Narcotics & Terror Network, The Grateful Unrich: Revolution in 50 Countries and Das Kartell der Federal Reserve. Subscriptions to his Left Hookblog are FREE at www.deanhenderson.wordpress.com

Footnotes:

[1] The Temple & the Lodge. Michael Bagent & Richard Leigh. Arcade Publishing. New York. 1989. p.259

[2] Ibid. p.219

[3] Ibid. p.253

[4] Ibid. p.233

[5] The Robot’s Rebellion: The Story of the Spiritual Renaissance. David Icke. Gateway Books. Bath, UK. 1994. p.156

[6] Democracy for the Few. Michael Parenti. St. Martin’s Press. New York. 1977. p.51

[7] Fourth Reich of the Rich. Des Griffin. Emissary Publications. Pasadena, CA. 1978. p.171

[8] Ibid. p.173

[9] Rule by Secrecy: The Hidden History that Connects the Trilateral Commission, the Freemasons and the Great Pyramids. Jim Marrs. HarperCollins Publishers. New York. 2000. p.68

[10] The Secrets of the Federal Reserve. Eustace Mullins. Bankers Research Institute. Staunton, VA. 1983. p.179

[11] Human Race Get Off Your Knees: The Lion Sleeps No More. David Icke. David Icke Books Ltd. Isle of Wight. UK. 2010. p.92

[12] Marrs. p.212

[13] Idid. p.139

[14] Ibid p.141

[15] Icke. The Robot’s Rebellion.p.114

[16] Ibid. p.181

[17] Rothschild: The Wealth and Power of a Dynasty. Derek Wilson. Charles Schribner’s Sons. New York. 1988. p.178

[18] The House of Rothschild. Niall Ferguson. Viking Press New York 1998 p.28

[19] Marrs. p.215

[20] Ibid

[21] “What You Didn’t Know about Taxes and the Crown”. Mark Owen. Paranoia. #41. Spring 2006. p.66

[22] Marrs. p.63

[23] “The Coming Fall of the House of Windsor”. The New Federalist. 1994

[24] “The Secret Financial Network Behind ‘Wizard’ George Soros”. William Engdahl. Executive Intelligence Review. 11-1-96

[25] Marrs. p.86

[26] “Murdoch, Rothschild Invest in Israeli Oil Shale”. Jerusalem Post. November 22, 2010

[27] “Sarah Palin hires chief of staff for PAC”, Huffington Post. February 2011

For that reason, the minutes are usually highly protected by the central bank and their release is supposed to be executed carefully.

For that reason, the minutes are usually highly protected by the central bank and their release is supposed to be executed carefully.