(Alt Market) - Washington is laying on the malaise pretty thick lately over automatic budget cuts set to take effect in March, with admonitions and partisan attacks galore. Of course, those of us who are educated in the finer points of our corrupt puppet government are well aware that the public debate between Democrats and Republicans amounts to nothing more than a farcical battle of Rock’Em Sock’Em Robots with only one set of hands behind the controls. The reality is, their decisions are scripted, their votes are purchased, and they knew months ago exactly how America’s fiscal cliff situation would progress. The drama that now ensues on the hill is meant for OUR benefit and distraction, and no one else.

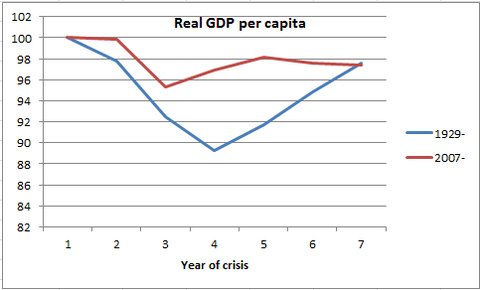

The Obama Administration warns that “sequestration” (austerity) will result in a return to recession for the U.S. News Flash, folks! The country never left the recession that officially began in 2008. Sorry to burst that inflated recovery hopium bubble…

Janet Napolitano warns that cuts will result in a greater risk of terrorist attacks. Apparently, an extra $85 billion per year buys us complete safety from the Muslim boogeyman, though the DHS has been far more concerned with “homegrown extremists” (people like me) than Al-Qaeda lately…

The White House and DHS has warned that funding for border control may be diminished, and the southern border will be left “wide open” to infiltration. Apparently, the White House is not aware that the southern border is ALREADY wide open. If they were truly concerned about the porous border, maybe they would refrain from decisions to release over 10,000 illegal immigrants from holding before cuts have even been finalized, sending a clear message to Mexico that there will be no consequences for anyone sneaking into the U.S. without permission…

The DOD warns that cuts to defense will result in a weakened military posture for America, and yet, our posture has already been greatly weakened by our numerous illegal wars in the Middle East (some overt, some covert). I have yet to see any tangible assessments on how our continued presence in Iraq and Afghanistan has made our nation safer…

Let’s put all of this into perspective; America’s current annual deficits have exceeded $1 trillion for the past four years. Our official national debt has expanded nearly $7 trillion in the span of five years. Through QE3 (QE infinity), the Federal Reserve is now pumping over $85 billion (that we know about) per month into our financial system. And in March, the federal government is being asked to cut $85 billion over a span of six months?

It sure seems like a drop in the bucket compared to the massive expenditures already taking place. Yet, these moderate cuts are being heralded as a sign of fiscal apocalypse by the White House and others. Why? Because America has reached the point at which any disruption in government liquidity will damage our recovery fantasy, and the establishment is acclimating us to the coming crisis so that we don’t immediately take up our torches and pitchforks. The lie is so tenuous, that the fiat must forever flow, or the illusion crumbles. Not only must spending continue unabated, it must also EXPAND with each passing year in order to handle the growing liabilities of entitlements and interest payments on capital already borrowed. Even the smallest of cuts could indeed send our economy into a tailspin (with a little help from the Federal Reserve and reduced currency creation), because that’s exactly how desperate our circumstances are.

Of course, the establishment plans to make matters worse by applying cuts where they will be most painfully felt by the populace. The fear mongering is reaching fever pitch with threats of wide open borders, weakened military superiority, lost government jobs, unemployed teachers, etc. But let’s imagine, just for one blissful moment, that the government was NOT utterly criminal and subversive; what kind of cuts would an honest government make right now in order to counter the dangers of debt disintegration and dollar devaluation?

…I really don’t know because I’ve never lived under an honest government. I have little personal experience in how one would behave. However, here is what I would cut from the budget…

Unnecessary Foreign Aid

Will some cuts be made to foreign aid after “sequestration”. Yes. But nowhere near enough. The U.S. spends around $50 billion a year on foreign aid, including $3 billion in “direct assistance” to Israel (meaning they get a lot more money and equipment through indirect means), $2 billion to Iraq, $1.7 billion to Pakistan, $1.4 billion to Egypt, $1.2 billion to Haiti (the Hatians are the only people on the list so far that actually need the money), and $1 billion to Kenya (…Kenya?). The list goes on and on. Even Mexico gets around $400 million a year in foreign aid from the U.S.

The establishment has conditioned the general public to consider any suggestion of cutting foreign aid to be taboo. Politicians on both sides of the aisle will wail and scream at the thought of reducing aid to Israel or other Middle East nations. That said, the bottom line is that we cannot afford it. You may believe every dollar to these countries results in the thwarting of evil doers and the filled bellies of orphan children. It doesn’t matter, because we can’t afford it. You may believe the whole of America’s international reputation and diplomatic sway hangs in the balance over foreign aid expenditures, but this is irrelevant, because we can’t afford it.

The most detrimental threats to the U.S. are INTERNAL and financial, not external, and cutting foreign aid would alleviate those detrimental threats by about $50 billion dollars. I’m a little tired of hearing how America is supposed to “export democracy” and keep its fingers in the cookie jars of nations around the world. This is a globalist philosophy that has never borne fruit and never will. It is time to bring the money back home where it might actually do some legitimate good.

Occupation Wars

The Neo-Cons played the American people like a banjo for nearly a decade claiming first that the invasions of Afghanistan and Iraq were necessary in order to defuse Al Qaeda influence. Then, when we realized that the resource rich fields of the Middle East were the true target, rather than the “terrorists”, they changed their tune and claimed that now it would be “irresponsible” to leave the region, regardless of the fallacy of the mission, because if we did innocent people would be left to chaos and ruin.

Ultimately, the Neo-Cons never cared about the innocent citizens of Iraq or Afghanistan, they only cared about manipulating the American public into acquiescing to continued occupation, and that is exactly what they did. Today, the Obama Administration carries on exactly where the Neo-Cons left off, using the same propaganda and the same lies with a new face and a new presentation.

Original cost estimates of the two invasions were around $100 billion for a two year involvement, and the American people were assured that this was all that was needed. Today, over a decade later, the costs have escalated to at least $4 trillion (Obama’s claim of a $1 trillion price tag is an outright fabrication), and still have not abated. If the government truly wanted to save massive amounts of capital and shield the populace from debilitating service and entitlement cuts, they would bring the troops home; ALL OF THEM, and stop flushing money down the toilet in the Middle East.

Instigations Of Foreign Insurgencies

Why is the Obama Administration continually pouring money into the coffers of Middle Eastern insurgencies led by Al Qaeda operatives that supposedly hate the U.S.? They did it in Egypt, they did it in Libya, and now they are doing it in Syria. Is Obama an idiot, or, is there a greater purpose at work? Is the goal to deliberately destabilize the region, or are they doing it out of blind hubris and stupidity? In either case, all the money being showered on these civil wars is a wretched waste, and should be stopped.

TSA Thugs

The Transportation Security Administration is the most hated institution in America. It is reviled across the country and its dubious purpose is questioned by almost everyone. Americans, no matter how uneducated and oblivious, still do not like being molested by blue gloved bureaucratic freaks with preexisting criminal records. We do not like having our small children molested by them either. We do not like being irradiated so that our naked pictures can be stored in a central database. We do not like thugs, brown shirts or blue shirts, ordering us around and looking down their noses at us. Frankly, Americans have a history of shooting those kinds of people…

DHS head Janet Napolitano has already released warnings ahead of budget cut decisions stating that the TSA may be on the chopping block, and that this would put American travelers “at risk”. I highly doubt that this is the plan, though…

The TSA is not meant to protect the citizenry in any way. It is a conditioning machine for the masses, and nothing more. It is designed to inhibit our natural rebellion against personal search and seizure tactics, and make us apathetic to deeper intrusions into our privacy. That is all. I find it highly unlikely that the establishment would dismantle such a useful tool of oppression. But, if Napolitano is sincere, then I say go for it Janey, do your worst! Abolish the whole damned agency, because if you don’t, eventually, we’ll do it for you.

The Criminal ATF

The Bureau of Alcohol Tobacco and Firearms has a long history of questionable and often illegal activities, usually ending with the murder of civilians with dissenting views. However, the latest snafu involves a much larger conspiracy, culminating in the agency being caught red handed feeding American weapons to violent Mexican drug cartels in an effort to stigmatize gun ownership in the U.S. and to wrongly attribute deaths in the border region to American gun dealers. This debacle is known as “Fast and Furious”.

Eric Holder, Attorney General of the U.S. and a staunch proponent of the ATF, has defended the Fast and Furious agenda to the point of contempt of Congress. Holder is a gun control advocate and key player in the current attacks on the 2nd Amendment, despite his habit of protecting agencies that feed weapons to psychopathic drug lords.

Any agency with this much schizophrenic disregard for the rights and safety of Americans should be wiped from the ass-end of history. It also has an annual budget of $1.2 billion, which could be spent in far better places, to be sure.

Big Brother DHS

What exactly does the Department of Homeland Security do that the FBI and the CIA did not already do before its inception? The great lie spread in the wake of 9/11 was that various alphabet agencies were not “in communication” with each other, and that intelligence gathered was not “reaching the right people”. Of course, Bush had received several warnings pre-9/11 of impending attacks, and the FBI and CIA on more than one occasion had the opportunity to apprehend Osama Bin Laden, but were thwarted by the Administration itself, sending a clear message that the government catches “terrorists” only when it WANTS to catch a terrorist.

The DHS was established as a means to centralize information sharing, but it has become much more. It now encompasses and directs much of the internal law enforcement outfits of the U.S. through so-called fusion centers, and even plays a growing role in external matters. Much of the analytical paperwork coming out of the agency, though, does not deal with foreign enemies like Al Qaeda. Rather, the agency is almost obsessively focused on “domestic threats”, like returning war veterans, Constitutionalists, gun rights champions, Ron Paul supporters, and Liberty Movement activists.

In the end, the DHS is intended to combat a specific opponent, and that opponent is obviously the American people.

The DHS is set to absorb $2.6 billion in cuts if sequestration goes though, causing the organization to spew dire prophecies of doom. Yet, the DHS is projected to have a $9 billion surplus by the end of 2013, and apparently has enough funding to place orders for over 2 billion rounds of combat ammunition (not for training purposes, sorry disinfo-agents). I say cut the head off the beast. Remove DHS, save American liberties, and spend those billions elsewhere.

Gitmo-Style Black Sites

I find it highly distasteful and disturbing that the U.S. government is operating black sites like GITMO where they can torture and murder in obscurity, rather than having to answer to the public, all while instituting these activities in our name. The common argument is that these prisons are necessary to isolate the most volatile of villains, and obtain vital data in the war on terror. Well, despite what you may have seen in the movie ‘Zero Dark Thirty’, torture rarely if ever produces reliable and concurrent intel that can be acted upon to prevent any impending attack, or apprehend any enemy agent. And, after what we saw at Abu Ghraib, the government has proven itself absolutely untrustworthy to handle incarcerated prisoners in any capacity, let alone in places where independent oversight does not exist.

Didn’t Obama make a campaign promise in 2008 to shut down GITMO, by the way? Why not do it now, save the country some cash, and end a disgusting and immoral practice that demeans the whole of our society?

Domestic Drone Programs

Why does the federal government need 30,000 drones in the skies over the heads of American citizens? Why is this being pursued? If the government seeks to make war on the American people, then by all means, admit that this is the goal and at least we will know the rationalization for spreading a spider’s web of remote controlled technotronic death from sea to shining sea. This is the only POSSIBLE purpose that such a fleet of drones could serve. If this is not the reason for the escalation of drone activity, then there is no logical reason, and they should be perfectly willing to end these programs, saving the U.S. millions if not billions of dollars.

Corporate Welfare

Long before the banker bailouts and the “too big to fails”, government has been pouring free money into the coffers of international corporations that were already claiming billions in capital. This welfare has reached epic levels; around $93 billion by some estimates. Why? Maybe because the establishment knew years ago that these companies were headed for debt implosion. Or, maybe because D.C. is a revolving door and corporate vampires like to spend time in the public sector bleeding taxpayers dry. I don’t know. What I do know is that whatever purpose corporate welfare was supposed to serve, it failed. We are in the midst of the most extensive economic crisis of all time, and many of the companies that received welfare for the past couple decades are debt addled failures that provide little in job creation. It’s time to cut our losses…

The Obama Family’s Extravagant Vacations

All this panicked discussion on budget cuts, yet, no one seems to be talking about reducing the most frivolous of expenditures. The Obama family’s four trips to Hawaii alone have cost Americans tax payers at least $20 million (this is a very conservative estimate)! Why is the nation pounding its collective head against the wall over extreme national debt obligations while this joker and his overprivileged family are spending a thousand times more on each of their vacations than any other citizen?

Hey Obama, try a trip to Florida, you money swilling bastard! Maybe you could squeeze it in for under a million? Take a swim in the Everglades perhaps, the water is fine…

One Day Soon, Everything Will Be Cut…

If Americans are frightened of a small budget cut of $85 billion, imagine what they’ll do when they realize this is just the beginning of the avalanche. It will not be long before our foreign creditors turn away from the Dollar and begin using alternative currencies like the IMF’s SDR basket. At that point, the purchasing power of the Greenback will be severely suffocated, and the numerous social services the public enjoys today will be buried as well.

Some people might question why I did not include any entitlement programs or social support in my list of needed budget cuts. I would only point out that such programs are not long for this world anyway, and though most of them shouldn’t exist in the first place, the expenditures listed above are even more peripheral. The feds will keep welfare going for as long as possible, in order to subdue public response and soften collective rage, but there will come a time when the food stamps, medicare, disability payments, and other subsidies will suddenly stop. EU members like Spain are a perfect example, stealing over 90% of social security funds in order to maintain a façade of solvency, while others are raiding retirement funds and employee pensions, all because austerity measures are exhausting entitlement pools. This is where the U.S. is headed, and it cannot be avoided. Not through fiat printing, or any other nonsensical strategy.

My goal was to merely point out that there are plenty of irrelevant federal appendages out there that could be amputated, but probably won’t be, while other more useful programs will come under fire. In the end, the budget cuts are not about saving money; they are about social maneuvering and political gain. They will be used as an excuse for everything, and will produce nothing favorable, not because cuts are not needed, but because the people in charge of them are not trustworthy.

New money: More than a dozen states have pushed laws through so that gold and silver can be used as legal tender

New money: More than a dozen states have pushed laws through so that gold and silver can be used as legal tender

Loss of faith: Conservative politicians are concerned about the economic policies put into place by Ben Bernanke during his time as the chairman of the federal reserve

Loss of faith: Conservative politicians are concerned about the economic policies put into place by Ben Bernanke during his time as the chairman of the federal reserve

Angry Arizonans: The Arizona House of Representatives passed the law through and now it continues through the process before it goes ahead an is enacted in the state

Angry Arizonans: The Arizona House of Representatives passed the law through and now it continues through the process before it goes ahead an is enacted in the state

For that reason, the minutes are usually highly protected by the central bank and their release is supposed to be executed carefully.

For that reason, the minutes are usually highly protected by the central bank and their release is supposed to be executed carefully.

(dinarvets.com) U.S DEPARTMENT OF HOMELAND SECURITY HAS TOLD BANKS – IN WRITING – IT MAY INSPECT SAFE DEPOSIT BOXES WITHOUT WARRANT AND SEIZE ANY GOLD, SILVER, GUNS OR OTHER VALUABLES IT FINDS INSIDE THOSE BOXES!

(dinarvets.com) U.S DEPARTMENT OF HOMELAND SECURITY HAS TOLD BANKS – IN WRITING – IT MAY INSPECT SAFE DEPOSIT BOXES WITHOUT WARRANT AND SEIZE ANY GOLD, SILVER, GUNS OR OTHER VALUABLES IT FINDS INSIDE THOSE BOXES!

The idea is that while you and I are required to transact business with piece of paper and ink, large banks and nations still settle their accounts with gold, which is simply wheeled from one nation’s vault to another to settle a debt, all of it under the roof of the Federal Reserve Gold Depository in New York City, or the similar institutions at the Bank of England and Band of France.

The idea is that while you and I are required to transact business with piece of paper and ink, large banks and nations still settle their accounts with gold, which is simply wheeled from one nation’s vault to another to settle a debt, all of it under the roof of the Federal Reserve Gold Depository in New York City, or the similar institutions at the Bank of England and Band of France.

It quickly became apparent that the problem of tungsten filled bullion bars was widespread. Because many of the fake gold bars had the marking of US sources, nations began to ask for audits and tests of the gold bullion held in their name by the New York Federal Reserve. To the surprise of many, the New York Federal Reserve refused! Indeed the New York Federal Reserve refused the German government permission to simply look at their bullion! Germany’s private central bank then went public assuring the Germans that they trusted America’s private central bank and did not need to see the gold. That was followed by a bizarre

It quickly became apparent that the problem of tungsten filled bullion bars was widespread. Because many of the fake gold bars had the marking of US sources, nations began to ask for audits and tests of the gold bullion held in their name by the New York Federal Reserve. To the surprise of many, the New York Federal Reserve refused! Indeed the New York Federal Reserve refused the German government permission to simply look at their bullion! Germany’s private central bank then went public assuring the Germans that they trusted America’s private central bank and did not need to see the gold. That was followed by a bizarre